3 Signs You Should Consider Debt Consolidation

Living with debt is something that no one truly wants to do. Month after month…

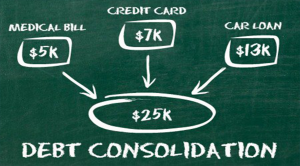

Living with debt is something that no one truly wants to do. Month after month of watching more expenses pile up than can actually be paid out can make even the most patient person be ready for a change. Fortunately, there is a better way to finally get out of debt. Debt consolidation can be a great route for many people. However, it can be difficult to actually know when debt consolidation is right for you. There are really 3 major signs that you should consider debt consolidation for your situation.

The first sign is having a high number of bills that appear month after month, such as credit cards. Debt consolidation can actually pull those together for you into one single payment, so you don’t have to sent out 8-9 envelopes every month or remember to write checks. You make one payment that covers all the bills.

The second sign is having bills with high interest rates. When the interest rate is too high, it can be difficult to actually see any progress in paying down past bills. A good debt consolidation loan can actually carry a lower interest rate than what you’re currently paying, helping you save money.

The final sign is something so many people are all too familiar with: feeling like you just can’t keep up anymore. This is one of the biggest signs a debt consolidation plan is something you should look into — no one should have to feel that way about their finances when there are so many resources out there to help you move forward to a bright debt-free future!

Overall, everyone will have unique reasons why debt consolidation is a right step for them. However, if you’re seeing your situation reflected in these three signs, you might want to look into a good debt consolidation plan today!