Debt Consolidation vs. Bankruptcy

You are drowning in a sea of bills. You owe more than you make. You…

You are drowning in a sea of bills. You owe more than you make. You spend many nights awake wondering how you are going to pay the mortgage. How are you going to pay the water, gas and electric bills? On top of that, you haven’t bought food yet, much less given your kids’ money for school or just to go to the mall. Many people are in the same situation you are. There are choices out there for people to help get them out of debt.

Whether you are where you are because of bad spending habits or maybe you got laid off at work, you do have choices. You can inherit a bunch of money from a relative you just found out about or maybe hit the lotto! Though these two examples would help you get out of debt, they aren’t very likely to happen. So you have to make a decision. You can keep doing what you are doing until finally you lose the house, or maybe just have to take cold showers in the dark. An alternative to this is debt consolidation or bankruptcy! Oh no I said the “B” word. As bad as it sounds compared to the way you’re heading right now, maybe it’s not so bad? There is also the option of debt consolidation. Both have good and bad aspects to them. Let’s look at both so you can make a decision that is right for you.

Bankruptcy will indeed wipe out your debt, all of it usually. But it will also wipe out your credit for many years depending on what kind of bankruptcy you choose. There are two forms of bankruptcy available to people like you and me. The first is Chapter 7. With Chapter 7 you must wait eight years before you can file again. Yes people have actually filed for bankruptcy more than once. Chapter 7 means your credit will be black marked for up to eight years. The other option is Chapter 13. With Chapter 13 bankruptcy you only have to wait two years between filings. Therefore, your credit will not take as long to build back up.

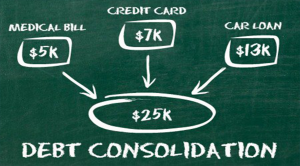

With both filings you are getting rid of your debt and your credit for at least two years. Now let’s look at debt consolidation. With debt consolidation a company of your choosing will usually work with your creditors to reduce the amount you owe. They also can lower your monthly payments and consolidate all into one monthly payment. Therefore, saving you money on a monthly basis. These companies usually charge fees, which will be added to the monthly payment you make. Debt consolidation will have a negative effect on your credit report, but not as much as bankruptcy. But, remember you still have the debt with debt consolidation, with bankruptcy you don’t. These are two options you have to get out from under that pile of bills. Now it is up to you to do some more research and see which one is right for you.