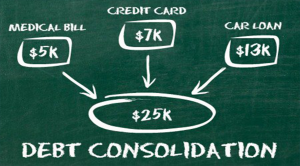

How to Properly Select a Debt Consolidation Company

There are an increasing number of debt consolidation companies available to those in need. Those…

There are an increasing number of debt consolidation companies available to those in need. Those in need of this service have plenty of organizations to choose from. For every legitimate business, there are those that strive to take advantage of innocent, desperate people. There dirty tricks include lending with an extremely high interest rate and choosing not to give advice on how to best properly handle yourself financially.

There are both profit and nonprofit debt consolidation organizations available to the consumer. A nonprofit business will not choose to charge a fee for their services, or perhaps a slight fee will be charged to those needing their services. Also entailed is a counseling service on how to handle your finances, and budget your funds in the long run.

The federal government bank rolls a nonprofit organization and companies that issue credit cards. They have the knowledge and general know how on how to appropriately budget and, more importantly, advise you on how to steer clear of over using your credit card. A nonprofit entity absolutely never consolidates loans, and if they choose to, the chosen rate will be at an acceptable interest rate. Due to the fact that they are nonprofit, the time it will take to clear up this type of particular business will be considerably longer.

A profit debt consolidation company, on the other hand, is safe and predictable, with no potential pitfalls awaiting any consumer. They will, by nature, act in a professional manner when overseeing the business of your credit card crisis. There is always a charge when dealing with them, but in the long run a customer will be far better off as the entire process will be much smoother and quicker. This is their stock and trade, so those in need will be treated fairly, this type of company being highly ethical in their practice as they have the ability to assist anyone with credit problems. Thus they enable their customers to receive a greater reduction in what they owe. This helps their customers to be free of their debt in no time at all.

Those requiring a debt consolidation company must do their homework when searching to locate the best company that meets their needs. Understanding what fees they charge for their services, as well as doing a credibility check, would be wise and prudent. The Better Business Bureau has information on every company, so finding out whether or not a company is reputable should be relatively easy and a wise step to take before entering into any business agreement.