How to Set Up a Trust in the UK: A Guide to Protecting Your Wealth

Protecting the hard-earned money you’ve accumulated is vital, but if all you’re doing is putting…

Protecting the hard-earned money you’ve accumulated is vital, but if all you’re doing is putting it into a standard savings account, you may not be maximizing your wealth preservation strategies. If you’re concerned about securing your heirs’ financial future, establishing a trust in the UK might be the right step.

Many people assume that trusts are only for the wealthy, but that’s a common misconception. Trusts are used globally and can benefit anyone with assets to protect, regardless of income. In the UK, trusts are designed to safeguard assets like property, investments, land, and money for beneficiaries, and they offer numerous benefits beyond just inheritance planning.

What is a Trust?

According to HMRC, a trust is defined as:

“A legal arrangement where one or more ‘trustees’ are made legally responsible for holding assets. The assets—such as land, money, buildings, shares, or even antiques—are placed in trust for the benefit of one or more ‘beneficiaries.'”

In essence, a trust allows you to transfer ownership of your assets to trustees, who manage them according to your instructions for the benefit of the people you care about. Trusts can be established for a variety of purposes, including estate planning, charitable giving, or even tax efficiency.

Why Set Up a Trust?

Setting up a trust in the UK offers several advantages, including:

- Control and Protection: Trusts allow you to control and protect the assets your family has worked hard to acquire. For example, you can ensure that assets are used for specific purposes, such as education or healthcare, or held until beneficiaries reach a certain age.

- Planning for Minors: Trusts are often used to hold money for minors or individuals unable to manage their financial affairs.

- Tax Efficiency: Depending on how it’s structured, a trust may offer tax benefits, especially regarding inheritance tax.

- Lifetime Asset Transfers: You can also pass on property or money to beneficiaries while you are still living, providing a flexible financial planning option.

In addition to family trusts, there are also non-family trusts, which are often established to run charities or set up pension funds for employees in a business.

Types of Trusts in the UK

When setting up a trust, it’s important to choose the right type based on your goals. Common types of trusts in the UK include:

- Bare Trusts: Assets are held in the beneficiary’s name, and they gain full access when they turn 18.

- Discretionary Trusts: Trustees have the flexibility to decide how and when assets are distributed to beneficiaries.

- Interest in Possession Trusts: Beneficiaries are entitled to income generated by the trust, but not the underlying assets.

- Charitable Trusts: These are set up for charitable purposes and may benefit from tax exemptions.

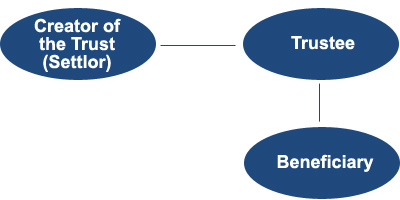

Key Roles in a Trust

- Settlor: The settlor is the person who places assets into the trust. It’s important to note that once assets are placed into a trust, they no longer legally belong to the settlor, though they can specify how the assets are managed.

- Trustees: Trustees are the legal owners of the trust’s assets. Their job is to manage the trust according to the instructions laid out in the trust deed and ensure that the assets are used for the beneficiaries’ benefit. They are also responsible for the day-to-day management, including handling tax implications and filing any necessary reports with HMRC.

- Beneficiaries: Beneficiaries are the individuals or organizations for whom the trust was created. They can receive either income from the trust or a portion of its assets.

How a Trust Grows and Generates Income

The assets held in a trust can generate income, such as interest on savings or dividends from shares. Trustees have a fiduciary duty to invest the trust’s assets wisely and generate maximum returns for the trust. This income can be reinvested to grow the trust or distributed to beneficiaries, depending on the terms set out in the trust deed.

Is Setting Up a Trust Right for You?

Before setting up a trust, it’s crucial to assess your current financial situation and future goals. Trusts come with certain responsibilities and ongoing costs, such as legal fees and tax implications. Therefore, professional advice is essential to ensure you are making the right decision for your family and finances.

Working with a solicitor or a tax adviser experienced in trust law can help you navigate the complexities and ensure that everything is in order. They will also help with trust tax returns and make sure the trust operates smoothly and efficiently.

Final Thoughts

Setting up a trust in the UK can be a smart move for anyone looking to protect their wealth and secure the financial future of their heirs. Trusts are not just for the rich—they can be an essential part of a long-term financial strategy. Whether you want to ensure your family’s assets are managed responsibly or create a charitable foundation, a well-structured trust can provide peace of mind and help you achieve your financial goals.