Why You May Need A Debt Consolidation Loan

Life has a way of throwing us curveballs when we least expect it, which might…

Life has a way of throwing us curveballs when we least expect it, which might leave us needing financial help. When your financial products start to mount and the repayments start to build, you may need to find a helpful solution. That’s where debt consolidation UK can help. If you are looking for support before applying, here is a quick guide to debt consolidation loans and why you may need one.

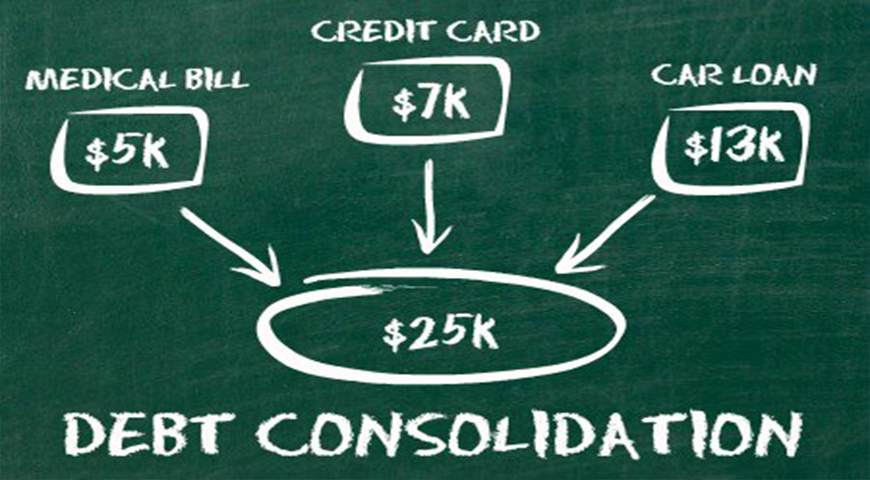

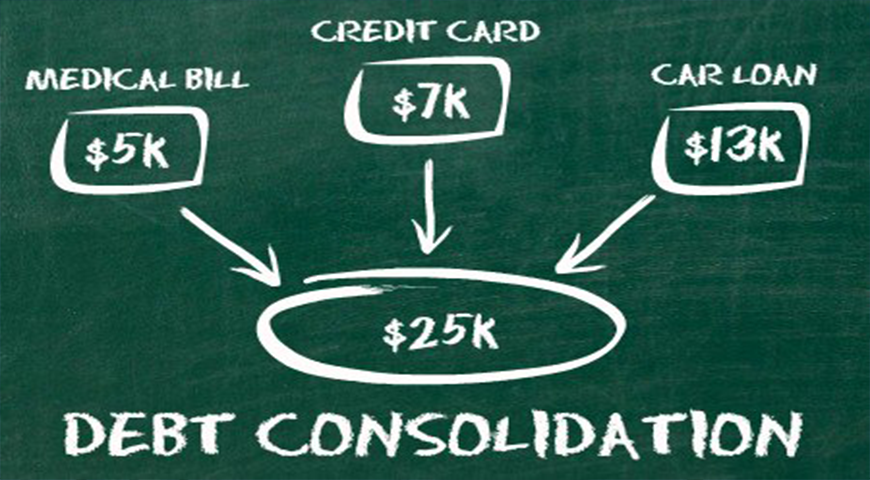

What Is A Debt Consolidation Loan?

Debt consolidation loans are designed to merge all of your existing debts into one figure. You borrow enough money to pay off all of your current debts and owe money to just one lender, rather than paying multiple lenders each month. This can allow you to budget better and provide peace of mind when thinking about your finances.

There are two types of debt consolidation loan:

Secured – this type of loan uses a high value asset as collateral, such as your house or car. Secured debt consolidation loans usually have lower interest rates, but if you miss repayments, your collateral could be repossessed by the lender.

Unsecured – this type of loan is not secured against an asset, so may result in higher interest rates, but offers less risk to the customer.

When Should I Consider A Debt Consolidation Loan?

Many other options, such as personal loans, can be used for just about anything you want. With a debt consolidation loan, their sole purpose is to provide relief from managing multiple debts. Applying for this type of loan only makes sense if:

You see it as an opportunity to reduce your spending and get your finances back on track

You can afford to keep up the repayments until the loan is fully repaid

Any savings are not wiped out by fees or charges

You end up paying less interest than you were paying before

If you feel as though you will not be able to afford the repayments or pay off all of your existing debts, you may need to consider other options first. It is also key to remember that you may end up paying more overall if you do not compare the interest rates to your debt repayments. If you find yourself in any of these situations, please seek impartial help from the Money Advice Service.

Which Debts Can A Consolidation Loan Pay Off?

As a debt consolidation loan is designed to only be used for paying off existing debts, there are a number of credit accounts that you can use them on. Effectively, you can take out a consolidation loan to pay off any form of debt, including:

Other loan repayments, such as personal or payday loans

Credit card debt

Overdrafts

Store cards

In truth, it does not usually matter what kind of debts you need to pay. If you owe money to multiple providers and need help with managing your cashflow, a debt consolidation loan may be able to help.

If you need any further information about debt consolidation loans, why you may need one, and how they can help you, do not hesitate to reach out to the Money Advice Service.