Tips to Help You Lower Your Credit Card Debt

Credit card debt can build up rapidly and without you realizing it. You can think…

Credit card debt can build up rapidly and without you realizing it. You can think you have everything under control, but when you next look at it you realize that it is much greater than you thought. We present you with three ways you can reduce this credit card debt quickly, and with a little amount of effort on your part.

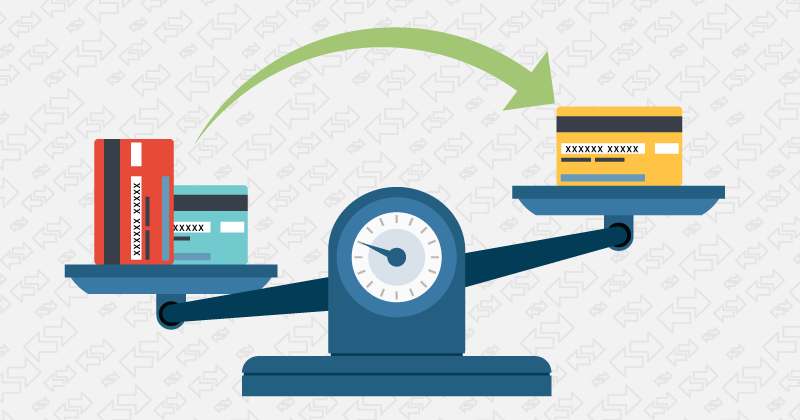

Many credit card companies introduce new cards all the time which offer introductory rates of 0%, sometimes for several months. If you have significant high interest debt on your cards, then transfer some or all of the outstanding balance onto a new card at 0%. This will allow you to pay off the principal sum much more quickly because less monthly interest will accrue.

If you have a few cards, transfer the smallest amounts first, pay this off, then do the same again. Close cards down which have no debts on them. This way you can help your credit score and also take advantage of any introductory offers next time.

Credit card companies want your business, they really do. So in order to keep you as a customer, they may offer you a reduced rate so that you will stay with them. If you find the prospect of such negotiation a bit daunting, then you can go to a credit management company. They can talk to your lenders for you. They can lower your monthly payments, or help you to consolidate all your debts into one manageable loan.

This may have an effect on your credit history for a short while, but in the long run, if it helps you to come out of debt, your credit report will recover in the end. In less than five years, you could be completely out of debt and not owe anyone any money.

If you go to a debt negotiation company, they will negotiate a reduction in the debt you owe. They can consolidate outstanding debt and talk to your lenders to see what is the minimum they are prepared to have you pay back. This is quite a drastic step, and only one step away from declaring bankruptcy and will significantly affect your credit score.

This will be much better for you in the long run. Eventually, as your debts get repaid, you will start to climb back up the ladder in terms of your credit score. This means that you will get much better interest rates when applying for credit in the future.