Should You Consolidate Your Debt?

There are a few considerations to make when determining whether or not to consolidate your…

There are a few considerations to make when determining whether or not to consolidate your debt. First, debt consolidation is a practice generally availed by those who are having trouble making their monthly payments. If you have no such trouble, but are interested in lowering your interest rates, it is probably better that you approach your creditors individually and negotiate for lower rates. Often, if you have been paying your bills on time, your creditors might offer you some interest relief. Such an arrangement has no reflection on your credit score.

If you are beginning to have some difficulty making your monthly payments and your future financial prognosis is not looking good, now may be the exact right time to consider debt consolidation. Since debt consolidation can require equity and/or a good credit score, you want to get into it before you begin to fall behind on monthly payments.

There are probably many banks and lending institutions in your local community who specialize in debt consolidation. Certainly, there are hundreds online. Do a little research and come up with the three lenders you think you would most like to work with. Contact each lender individually and discuss your situation in regard to debt consolidation. They will be able to advise you as to what they think are your best tactics and offer you a proposal on a specific agreement for you.

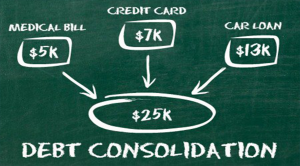

Before making a choice for or against debt consolidation, consider the three most important elements of a debt consolidation loan, and what you consider to be the most important among them. The three basic elements of a debt consolidation loan are interest rate, term (length) of the loan, and the amount of your monthly payment. Also, be sure to compare these elements when choosing the lender for your debt consolidation loan.

Not everything about a debt consolidation loan is hearts and flowers. You will want to keep in mind that unlike your credit card bills, a debt consolidation loan may require collateral. The most obvious collateral would be your home or car, and you could lose them if you default on your obligation. Also, the greatest impact on your monthly payments will be the term, or length, of your loan. The term will, no doubt, be extended in order to realize the lowest monthly payments. Be aware that this means that you will be paying this loan over a longer period of time.