Eliminating Your Debt by Way of Debt Consolidation

Nowadays, many people are experiencing a hard life. Lots of individuals are dealing with low…

Nowadays, many people are experiencing a hard life. Lots of individuals are dealing with low income and also huge debts. Having a huge debt is a serious problem and there seems to be no way of eliminating it. What usually are the causes of enormous and continuously increasing debts? People obtain loans for so many reasons. Some acquire loans so they can purchase a home or car, while others use them for their home improvements or renovations.

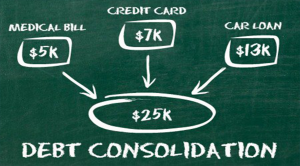

However, it seems that there are more people that do not use their brains when obtaining loans, and this is what gets them to trouble. They end up having debts left and right, and all they want is for this to end. If you are one of these people struggling hard to get out of debt, the best probable option for you is debt consolidation.

There are a lot of debt consolidation companies that offer loans to severely indebted people online. Aside from the loan they’re offering, they also provide debt counseling and debt management services. If you are lucky to find a good debt consolidation company, it is certain that you will be able to eliminate all of your debts in no time.

Debt consolidation loans have several benefits, and having low interest rates is basically what stands out the most. This also gives you a chance to save more for your other needs, such as food and clothing. In addition, debt consolidation can also help reduce stress.

Debt consolidation has 2 types, namely, the secured and the unsecured loans. A secured loan can be availed if you can present a valuable property like your home or car as your collateral. By having collateral, the interest rate that will be applied on your loan will be lower as compared to an unsecured loan where you do not have collateral. Unsecured loans are usually granted to individuals with low credit ratings or bad credit record. However, even if you have a good credit record, you may still opt for an unsecured loan.

It is not that difficult to obtain a debt consolidation loan because you are not really required to hand over a property, but you may need first to have a great knowledge about it and how to go about the processes involved in it. This way, you will be successful in freeing yourself from the bondage of debt.