Introduction to Debt Reduction

If you ever find yourself in a difficult financial situation, without a doubt a loan…

If you ever find yourself in a difficult financial situation, without a doubt a loan will be a very wise alternative. Note that taking a loan isn’t a crime, non repayment of it is. When the problem starts to get out of hand with more than several loans and debts under your name, debt reduction could be the only effective solution. As effective as it may be, knowing the ways of debt reduction is a hard nut to crack. The only way you can lead a trouble free and happy future is to dispose of your liability, but how do you do it?

First and foremost you need to prioritize and categorize all your outstanding debts by making a list of all the payments you make in a typical month, your mortgage payment inclusive. If you find you have a high debt, making adjustments will prove very helpful. Arrange your debts in a hierarchical order so that you can prioritize the most important ones. This way, you will be able to clear off debts on a more urgent basis. Needless to mention, you should channel most of your payments towards clearing the debts that are high on your priority list.

The second step should be to set and stick to a budget. When you set up a budget, you get to realize your financial goals and how to effectively manage your finances. Once the budget is set, you should discipline yourself in sticking to it, and avoiding borrowing money gratuitously. Learn how to stick within the budget since an overstep could lead to mismanagement of your finances, which you lead in accruing more debt. By the same token, you should limit your credit card usage to only those times that genuinely warrant its use.

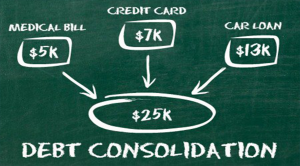

The third thing that will help you when seeking debt reduction is debt consolidation. When things seem to get out of control, with so many debts and loans under your name, consolidating them under a single umbrella remains the only practical alternative at your disposal. There are very many companies today that offer debt consolidation services, so you should take your time to choose one that will help you depending on your personal financial needs.

When you consolidate your debts into a situation where you will be paying a single monthly sum, you can rest assured of a much needed financial relief, if not for anything else because you can at least keep your lenders away as they cannot have the powers to resort to any measures, at least for the time being. A debt consolidation company will negotiate with your creditors and how you will be paying them on your behalf; hence you wouldn’t be faced with a situation of tough negotiations. Even while debt consolidation seems to be the best option, it is always advisable that you resolve your issues on your own and only seek assistance when you can’t avoid it any more.

Debt reduction is very convenient and achievable with some dedication and sincere efforts. It doesn’t have to be rocket science. You simply follow the abovementioned steps and you will be on your way to your financial freedom.